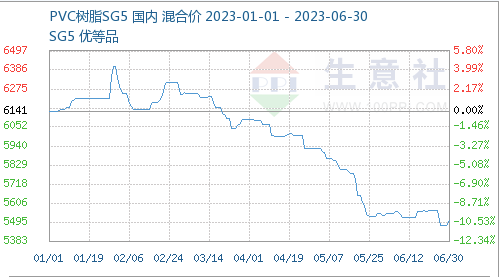

2023 წლის იანვრიდან ივნისამდე PVC-ის ბაზარი დაეცა. 1 იანვრის მონაცემებით, ჩინეთში PVC კარბიდის SG5-ის საშუალო ფასი 6141.67 იუანი/ტონა იყო. 30 ივნისის მონაცემებით, საშუალო ფასი 5503.33 იუანი/ტონა იყო და წლის პირველ ნახევარში საშუალო ფასი 10.39%-ით შემცირდა.

1. ბაზრის ანალიზი

პროდუქტის ბაზარი

2023 წლის პირველ ნახევარში PVC ბაზრის განვითარებიდან გამომდინარე, PVC კარბიდის SG5-ის სპოტური ფასების რყევა იანვარში ძირითადად ზრდით იყო განპირობებული. ფასები ჯერ გაიზარდა, შემდეგ კი დაეცა თებერვალში. ფასები მერყეობდა და დაეცა მარტში. ფასი აპრილიდან ივნისამდე დაეცა.

პირველ კვარტალში PVC კარბიდის SG5-ის სპოტური ფასი მნიშვნელოვნად მერყეობდა. იანვრიდან მარტამდე კუმულაციური კლება 0.73%-ს შეადგენდა. PVC Spot ბაზრის ფასი იანვარში გაიზარდა და PVC-ის ღირებულება გაზაფხულის ფესტივალის პერიოდში კარგად იყო მხარდაჭერილი. თებერვალში წარმოების განახლება მოსალოდნელი არ იყო. PVC Spot ბაზარი ჯერ დაეცა, შემდეგ კი გაიზარდა, საერთო ჯამში მცირედი კლებით. ნედლეულის კალციუმის კარბიდის ფასების სწრაფმა კლებამ მარტში სუსტი ფასების მხარდაჭერა გამოიწვია. მარტში PVC Spot ბაზრის ფასი დაეცა. 31 მარტის მდგომარეობით, ადგილობრივი PVC5 კალციუმის კარბიდის კოტირების დიაპაზონი ძირითადად 5830-6250 იუანი/ტონაა.

მეორე კვარტალში PVC კარბიდის SG5 სპოტური ფასები დაეცა. აპრილიდან ივნისამდე კუმულაციური კლება 9.73%-ს შეადგენდა. აპრილში ნედლეულის, კალციუმის კარბიდის ფასი კვლავ შემცირდა და ფასების მხარდაჭერა სუსტი იყო, ხოლო PVC-ის მარაგები მაღალი დარჩა. აქამდე, სპოტური ფასები კვლავ შემცირდა. მაისში, ქვედა ბაზარზე შეკვეთებზე მოთხოვნა ნელი იყო, რამაც საერთო შესყიდვების ცუდი მაჩვენებელი გამოიწვია. ტრეიდერები აღარ ინახავდნენ მეტ საქონელს და PVC სპოტური ბაზრის ფასი კვლავ შემცირდა. ივნისში, ქვედა ბაზარზე შეკვეთებზე მოთხოვნა ზოგადი იყო, ბაზრის საერთო მარაგებზე ზეწოლა მაღალი იყო და PVC სპოტური ბაზრის ფასი მერყეობდა და დაეცა. 30 ივნისის მდგომარეობით, PVC5 კალციუმის კარბიდის შიდა კოტირების დიაპაზონი დაახლოებით 5300-5700 ტონაა.

წარმოების ასპექტი

ინდუსტრიის მონაცემების თანახმად, 2023 წლის ივნისში PVC-ის შიდა წარმოებამ 1,756 მილიონი ტონა შეადგინა, რაც თვის განმავლობაში 5,93%-ით და წლიურად 3,72%-ით შემცირდა. იანვრიდან ივნისამდე კუმულაციური წარმოება 11,1042 მილიონ ტონას შეადგენდა. გასული წლის ივნისთან შედარებით, კალციუმის კარბიდის მეთოდით PVC-ის წარმოებამ 1,2887 მილიონი ტონა შეადგინა, რაც გასული წლის ივნისთან შედარებით 8,47%-ით და გასული წლის ივნისთან შედარებით 12,03%-ით შემცირდა. ეთილენის მეთოდით PVC-ის წარმოებამ 467300 ტონა შეადგინა, რაც გასული წლის ივნისთან შედარებით 2,23%-ით და გასული წლის ივნისთან შედარებით 30,25%-ით გაიზარდა.

ოპერაციული ტარიფის თვალსაზრისით

ინდუსტრიის მონაცემების მიხედვით, 2023 წლის ივნისში შიდა PVC-ის ოპერაციული მაჩვენებელი 75.02% იყო, რაც გასული წლის ანალოგიურ პერიოდთან შედარებით 5.67%-ით და გასული წლის ანალოგიურ პერიოდთან შედარებით 4.72%-ით ნაკლებია.

იმპორტისა და ექსპორტის ასპექტები

2023 წლის მაისში ჩინეთში სუფთა PVC ფხვნილის იმპორტის მოცულობამ 22100 ტონა შეადგინა, რაც გასული წლის ანალოგიურ პერიოდთან შედარებით 0.03%-ით და გასული წლის ანალოგიურ პერიოდთან შედარებით 42.36%-ით ნაკლებია. იმპორტის საშუალო თვიური ფასი 858.81 იყო. ექსპორტის მოცულობამ 140300 ტონა შეადგინა, რაც გასული წლის ანალოგიურ პერიოდთან შედარებით 47.25%-ით და გასული წლის ანალოგიურ პერიოდთან შედარებით 3.97%-ით ნაკლებია. ექსპორტის საშუალო თვიური ფასი 810.72 იყო. იანვრიდან მაისამდე ექსპორტის მთლიანი მოცულობა 928300 ტონას, ხოლო იმპორტის მთლიანი მოცულობა 212900 ტონას შეადგენდა.

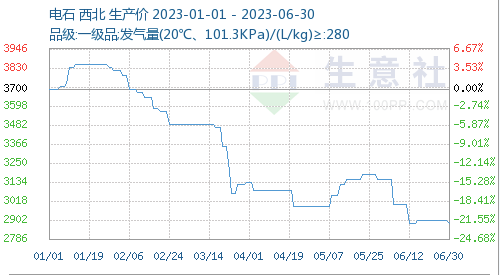

კალციუმის კარბიდის ზედა დინების ასპექტი

კალციუმის კარბიდის თვალსაზრისით, ჩრდილო-დასავლეთ რეგიონში კალციუმის კარბიდის ქარხნული ფასი იანვრიდან ივნისამდე შემცირდა. 1 იანვარს კალციუმის კარბიდის ქარხნული ფასი 3700 იუანი/ტონა იყო, ხოლო 30 ივნისს - 2883.33 იუანი/ტონა, რაც 22.07%-ით შემცირებაა. ზედა ნაკადის ნედლეულის, როგორიცაა ორქიდეის ნახშირი, ფასები დაბალ დონეზე სტაბილურია და კალციუმის კარბიდის ღირებულების მხარდაჭერა არასაკმარისია. კალციუმის კარბიდის ზოგიერთმა საწარმომ დაიწყო წარმოების განახლება, რამაც გაზარდა მიმოქცევა და მიწოდება. ქვედა ნაკადის PVC ბაზარი შემცირდა და ქვედა ნაკადის მოთხოვნა სუსტია.

2. სამომავლო ბაზრის პროგნოზი

წლის მეორე ნახევარში PVC-ის სპოტური ბაზარი კვლავ მერყეობს. მეტი ყურადღება უნდა მივაქციოთ კალციუმის კარბიდის ზედა და ქვედა დინების ბაზრებზე მოთხოვნას. გარდა ამისა, ტერმინალის უძრავი ქონების პოლიტიკის ცვლილებები ასევე მნიშვნელოვანი ფაქტორებია, რომლებიც გავლენას ახდენენ ამჟამინდელ ორ ქალაქზე. მოსალოდნელია, რომ PVC-ის სპოტური ფასი მნიშვნელოვნად მერყეობს მოკლევადიან პერსპექტივაში.

გამოქვეყნების დრო: 2023 წლის 13 ივლისი